SafePoint is proud to be rated favorably by leading independent rating organizations. These companies specialize in reviewing, analyzing and attesting to insurance companies’ financial security and their ability to deliver on promises made to policyholders.

We’ve Weathered the Storms… ALL OF THEM!

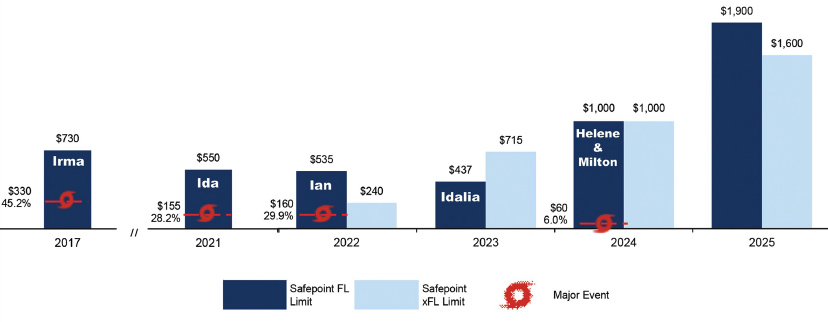

We have handled claims for over 15 named storms, Matthew, Irma, Michael, Laura, Sally, Delta, Zeta, Eta, Nicholas, Ida, Ian, Nicole, Idalia, Beryl, Debbie, Francine, Helene, and Milton, and in no single instance (or year) did we deplete half our claims paying abilities. Since 2017 we have managed over 90% of catastrophe claims with our own resources, including in-house claims field staff adjusting the insured losses.

We’ve Weathered the Storms… ALL OF THEM!

Demotech Rating

Demotech has assigned the rating of A Exceptional to SafePoint.

Demotech has assigned the rating of A Exceptional to SafePoint.

This financial stability rating is an indication of an insurance company’s financial strength. According to Demotech, an A rating means Safepoint has an Exceptional ability to maintain liquidity of invested assets, quality reinsurance, acceptable financial leverage and realistic pricing while simultaneously establishing loss and loss adjustment expense reserves at reasonable levels. For details, visit Demotech on-line here.

Kroll Bond Rating Agency Rating (KBRA)

Kroll has assigned Safepoint a BBB+ rating. According to KBRA, a BBB rating means that the insurer’s financial condition is good and the entity is likely to meet its policyholder obligations.